|

|

|

Wednesday 23 July 2003

Urban Planning

Housing Subsidies — For Transit? Every once in a while, I begin to think that the worst of the Washington area’s traffic idiocy has passed, and that we’re now ready to do something that’ll work, rather than just make headlines. And then something like the Smart Commute Initiative comes along. The Smart Commute Initiative is a wheeze where the Washington-area transit gods, Fannie Mae, a couple of banks, a number of builders, and various government agencies encourage people to buy houses near train stations or bus lines. If you take the bait, you get half-price train and bus fares for six months, and, though a complicated system, you get to buy a house that might have otherwise been too expensive for you. The participating lenders raise their estimate of what they think you can afford to pay by up to $250 a month. The main problem with this scheme is that there’s already very strong demand for housing near good public transit in the Washington area. Right now, very near the East Falls Church Metro station, a ‘community’ of ‘luxury towns’ — that is, attached houses — is going up.

These 21-foot-wide townhouses aren’t too bad as townhouses go; they have two-car garages, three bedrooms, two-and-a-half bathrooms, and kitchen islands. Optional gas fireplaces are available in all models. All of the models, incidentally, cost more than $800,000. That’s eight hundred thousand United States dollars, or approximately the cost of four or five similar houses not near Metro stations. As I said, there’s nothing wrong with these houses — they’re a little cramped by American standards, but only a little. But even in the Washington area, you can buy quite a lot of house for almost a million dollars. It wouldn’t be unusual for an $800,000 house to include a swimming pool, a four-car garage, quarters for a maid or an au pair, etc. You can have all that, or you can have proximity to the Metro station. This would seem to indicate that the problem is not that people won’t live near mass transit unless you offer them some dubious bribes. Rather, it seems that the supply of transit-proximal housing is nowhere near meeting the demand. The aerial photo below shows the location of this instant rich man’s neighborhood. The approximate location of the new houses is the vaguely rectilinear shape; the metro station is circled below it. Note that the two are separated by a large parking lot.

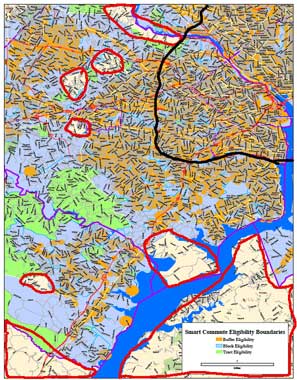

This isn’t a bad neighborhood, but it doesn’t really offer what you’d want for $800,000. Living in a townhouse, you don’t have a palatial back yard and a lot of privacy; but living here, you don’t get many of the benefits of density, either. This isn’t a pleasant neighborhood of cafés and such; it’s mainly residential, with a freeway running through the middle and a few car-repair places along the main road. The Metro station is almost the only draw. Now, as it happens, I’ve been a bit disingenuous here; these houses would not be covered by the Smart Commute Initiative, which only covers mortgages up to $322,000. And it doesn’t only cover houses near Metro stations; it covers houses near bus stops, too. And it covers houses that are near bus stops, but not quite so near; it appears that if one house in a development is eligible, they all are. Oh, hell, here’s a map:

(You can download a massive PDF version of this map here.) Orange areas have ‘buffer eligibility’; that is, they’re within a half mile of a Metro station or 1/4 mile of a bus stop. Blue areas have ‘block eligibility’. And green areas have ‘tract eligibility’. The only areas that appear to be totally ineligible for the program are those that I’ve circled with heavy red lines. I’ve outlined the Capital Beltway with a heavy black line, for scale. So a program that was intended to help make the Washington area a more livable place amounts to a Fannie Mae subsidy to a couple of banks, which are now allowed to make slightly-riskier mortgage loans. Fannie Mae ordinarily wouldn’t buy these loans from the banks, but ‘transit’ apparently has an influence on risk. The dazzling stupidity of this is hard to express in mere words. Somehow this calls for a ballet, or a mobile, or some kind of installation work involving television sets. Because at the same time that Fannie Mae is doing this, they’re complaining that there isn’t enough affordable housing in the United States. That they are themselves inflating the price of housing by making it easier for people to buy houses they couldn’t ordinarily afford doesn’t occur to them, I suppose. Currently, if you make about $59,000 a year, Fannie Mae says that you can afford a house payment of $1135. At 5.5% interest, this means a $200,000 house. But if it’s a transit-friendly house — read: almost any house in the Washington area, apparently — you can afford $250 more a month, or $1385. This means a $245,000 house, 19% more expensive. (This is all oversimplified; there are a lot of costs other than principal and interest in a mortgage payment. If you make $59,000 a year, you can’t actually afford a $200,000 mortgage. As the house price drops, though, the extra $250 a month that Fannie Mae is allowing actually inflates the price of the house you can now ‘afford’ even more, relatively.) Of course, you still have to come up with the $1385 a month, so the Fannie Mae policy won’t actually result in 19% inflation in the price of houses. It will, however, result in some inflation in the price of houses, thus reducing the stock of ‘affordable’ houses even more. Undoubtedly, the solution to that will be another special program. Repeat the process long enough, and Fannie Mae will go broke and have to be bailed out by the taxpayers. Posted by tino at 23:55 23.07.03This entry's TrackBack URL::

http://tinotopia.com/cgi-bin/mt3/tinotopia-tb.pl/171 Links to weblogs that reference 'Housing Subsidies -- For Transit?' from Tinotopia. Comments

You know this is what I expect from the likes of the Washington Post or New York Times when reporting on issues….not just a bunch of paraphrased press releases and quotes strung together by a reporter. Posted by: Paul Johnson at July 24, 2003 04:34 PM |